How Small Business Accountant Vancouver can Save You Time, Stress, and Money.

Wiki Article

Rumored Buzz on Small Business Accountant Vancouver

Table of ContentsPivot Advantage Accounting And Advisory Inc. In Vancouver - QuestionsHow Vancouver Tax Accounting Company can Save You Time, Stress, and Money.The smart Trick of Small Business Accounting Service In Vancouver That Nobody is Talking AboutWhat Does Vancouver Accounting Firm Mean?

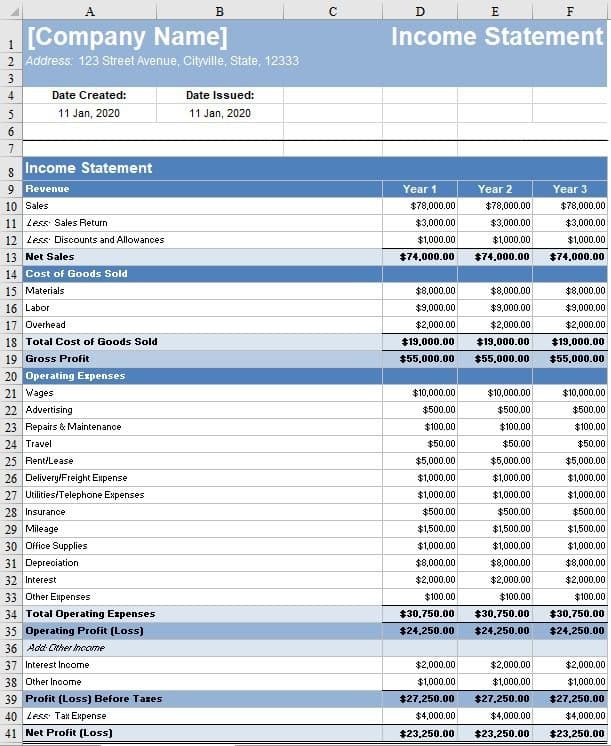

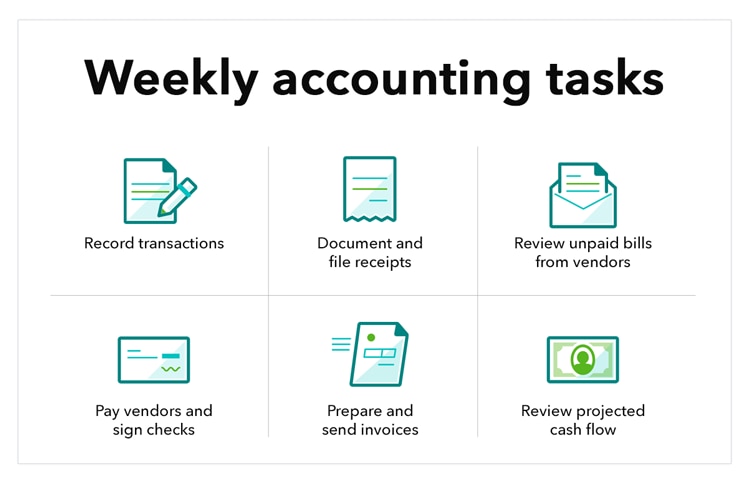

That takes place for every single solitary deal you make throughout a provided audit period. Your bookkeeping period can be a month, a quarter, or a year. All of it boils down to what works best for your business. Dealing with an accountant can help you discuss those information to make the accountancy process benefit you.

You make modifications to the journal entries to make sure all the numbers include up. That could consist of making modifications to numbers or managing built up items, which are expenditures or income that you sustain however do not yet pay for.

For striving money experts, the concern of accountant vs. accountant is typical. Accountants as well as accounting professionals take the very same foundational audit courses. Nevertheless, accountants take place for further training and education, which causes distinctions in their roles, earnings expectations as well as profession growth. This guide will give a comprehensive failure of what separates bookkeepers from accountants, so you can understand which audit role is the ideal fit for your job ambitions now and also in the future.

Some Known Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver.

An accounting professional builds on the info given to them by the accountant. Usually, they'll: Evaluation financial statements prepared by a bookkeeper. The records reported by the bookkeeper will certainly determine the accounting professional's guidance to leadership, and inevitably, the health and wellness of the organization generally.e., government companies, universities, health centers, etc). A well-informed and skilled bookkeeper with years of experience and also first-hand understanding of bookkeeping applications ismost likelymore certified to run guides for your business than a current accounting significant graduate. Maintain this in mind when filtering applications; attempt not to evaluate applicants based upon their education alone.

Organization projections and also fads are based on your historical monetary data. The economic information is most reliable as well as precise when supplied with a robust and organized audit procedure.

Examine This Report on Outsourced Cfo Services

An accountant's job is to preserve complete documents of all cash that film the accountant has actually come into and also gone out of the company. Their records make my latest blog post it possible for accountants to do their tasks.Generally, an accountant or proprietor looks after a bookkeeper's work. An accountant is not an accounting professional, neither should they be taken into consideration an accountant.

3 primary aspects influence your costs: the solutions you want, the know-how you need and your regional market. The accounting services your organization demands and the quantity of time it takes weekly or regular monthly to finish them impact how much it costs to work with an accountant. If you need somebody ahead to the office when a month to fix up guides, it will certainly set you back less than if you need to work with a person full-time to manage your everyday procedures.

Based on that calculation, determine if you need to hire someone permanent, part-time or on a job basis. If you have complex publications or are generating a great deal of sales, work with a qualified or certified accountant. An experienced accountant can offer that site you peace of mind as well as confidence that your funds remain in good hands yet they will certainly additionally cost you more.

About Tax Accountant In Vancouver, Bc

If you stay in a high-wage state like New York, you'll pay more for an accountant than you would certainly in South Dakota. According to the Bureau of Labor Data (BLS), the national average income for bookkeepers in 2021 was $45,560 or $21. 90 per hour. There are numerous benefits to working with a bookkeeper to file and document your organization's financial documents.

After that, they might pursue added accreditations, such as the CPA. Accountants might likewise hold the setting of accountant. Nevertheless, if your accounting professional does your bookkeeping, you might be paying greater than you ought to for this service as you would generally pay more per hr for an accounting professional than an accountant.

To complete the program, accounting professionals have to have 4 years of relevant work experience. The point below is that hiring a CFA means bringing extremely sophisticated accounting knowledge to your service.

To receive this qualification, an accountant must pass the required tests as well as have 2 years of expert experience. Certified public accountants can carry out some of the very same services as CIAs. Nonetheless, you could employ a CIA if you desire a much more specialized focus on financial threat evaluation as well as safety monitoring processes. According to the BLS, the average salary for an accounting professional in 2021 was $77,250 per year or $37.

Report this wiki page